The chairmen of the House and Senate tax-writing committees are preparing what they say will be major tax-reform proposals, and both are looking to an obscure congressional agency to make the numbers work.

This normally would be a fairly straightforward task. This year, however, will be different: Republicans now require Congress’ nonpartisan budget analysts to use dynamic scoring — that is, factoring in possible economic benefits of tax cuts considering their effect on the budget.

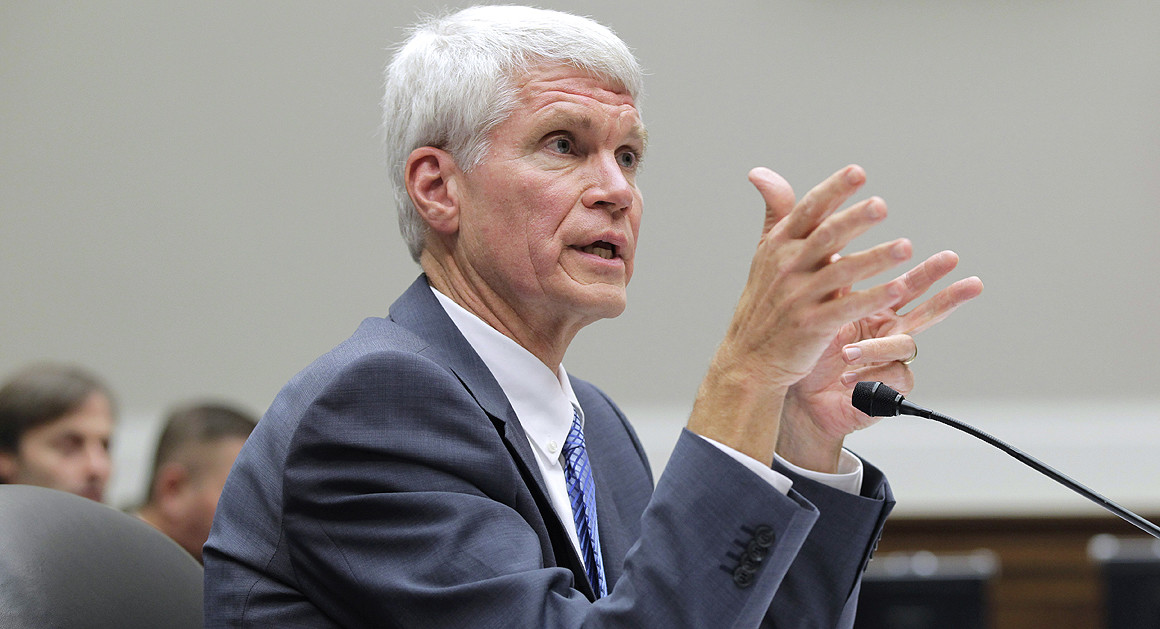

And that means that very soon, a bunch of people will get mad at Tom Barthold, the Harvard-trained economist heading the little-known Joint Committee on Taxation, which will decide how much the lawmakers’ proposals will cost. He is not looking forward to it.

“We’re going to try and do reasoned analysis, and grounded as possible in middle-of-the-road economic work,” Barthold said.

But is this even a good idea? he was asked.

“That’s really too political,” said Barthold, a onetime Dartmouth College economics professor. “We’ll try to offer the best analysis that we can so [lawmakers] can make good decisions. Whether the world is better under the new concurrent resolution than a world without, I’ve got to decline to answer that. That’s really for members to decide.”

Indeed, for much of its history, the JCT has done its job of putting a price tag on legislative proposals without attracting much attention. It’s an umpire so anonymous that even government insiders confuse it for its sister agency, the Congressional Budget Office.

But last year, the JCT’s job got a lot harder, and potentially a lot more controversial, when Congress adopted dynamic scoring. Republicans, eager to show the benefits of tax cuts, changed lawmakers’ budgeting rules to require JCT to take into account the economic effects of tax changes when tallying up the cost. It sounds deceptively simple, but there was just one problem: Republicans never told anyone how to implement dynamic scoring. They just said to do it, and left the details to Barthold.

That is forcing Barthold’s scrupulously impartial office of some 50 tax economists and lawyers to take sides in Congress’ never-ending theological wars over taxes. Agree with Republicans that overhauling the tax code would do wonders for the economy, and Democrats will scoff. Pegging the effects closer to nonexistent would amount to blasphemy to many Republicans. Either way, the credibility of the 90-year-old agency will be at stake, and he will soon get his first big test.

Senate Finance Committee Chairman Orrin Hatch said he will release a “corporate integration” plan within a matter of weeks. It aims to cut the taxes paid by corporations, without actually touching the corporate tax rate, by shifting the tax burden to their shareholders. House Ways and Means Committee Chairman Kevin Brady, meanwhile, said he’s working on a plan to revamp the way multinational corporations are taxed. Dynamic scoring can potentially generate hundreds of billions of dollars in essentially free revenue, sparing tax reformers from having to make quite so many cuts to make the numbers behind the proposals add up. It also can provide independent confirmation that their proposals would boost the economy, helping them sell what will surely be controversial plans to their colleagues.

Other nongovernment groups, some unabashedly partisan, have already begun to employ dynamic scoring models of their own, most notably on Donald Trump’s tax plan. But JCT’s opinion is the only one that really matters because lawmakers are required to use its figures.

Barthold, a Harvard-trained economist, agreed to sit down for an interview with POLITICO to talk about the process by which his team has done something that it had never had to do before. It amounts to a rare look inside the black box of one of the most influential and little-understood agencies in Washington. Barthold’s statements, cautious as they are, combined with examples of rulings the agency has issued on lesser-known bills, give the clearest idea of what to expect when the tax bills emerge.

To understand why Republicans are so passionate about the transformative potential of dynamic scoring, it’s important to understand how tax cuts have been analyzed until now. Under traditional scoring rules, all tax changes looked the same. JCT assumed there would be behavioral responses to changes. If Congress raised the excise tax on cigarettes, it assumed some people would quit smoking. If lawmakers increased the top income tax rate, the agency figured some people would put more money into tax-free municipal bonds to lower the tax. If they raised the capital gains tax, JCT said that would affect when people decide to sell stocks.

But it never had to reckon with broader questions like what effect those changes would have on jobs, economic growth and other big macroeconomic issues. By long-standing convention, all of that was presumed to remain constant.

Requiring dynamic scoring, one of the first things Republicans did when they took control of Congress last year, is a transparent effort by the GOP to make it easier to cut taxes by reducing the cost of the cuts to the Treasury. If tax cuts juice the economy, which then produces more tax revenue, then the net cost to the government is lower and Democrats have less to complain about. Of course, Democrats have complained that dynamic scoring, which they’ve mocked as “fuzzy math” and “voodoo economics,” will only mask the true cost of tax cuts.

In truth, even some Democrats thought it was more than a little absurd to think that a big tax bill wouldn’t turn the dials on the economy in some measurable way. Among them: Doug Elmendorf, director of the CBO until Republicans pushed him out, who argues critics of dynamic scoring need to chill out.

Under the old rules, Elmendorf pointed out, even President Barack Obama’s stimulus package was assumed to have zero impact on the economy. Had dynamic scoring been in place at the time, he said, it would have reduced the $800 billion price tag of the stimulus by about one-quarter.

“The traditional approach includes no behavioral responses by people or businesses that would change the overall size of the economy, and we know that isn’t right for some pieces of legislation,” said Elmendorf. “Estimates of macroeconomic effects are uncertain but so are other estimates. And I think it’s better to have an approximate estimate than to have no estimate at all.”

JCT’s adoption of dynamic scoring has put pressure on other budget analysts to follow suit, including the Tax Policy Center.

“We’d like to be able to match what they do,” said Roberton Williams, a fellow at the group, which produces widely noted analyses of the White House contenders’ tax plans. It’s now building its own dynamic scoring model.

Even liberals like Jared Bernstein, a former adviser to Vice President Joe Biden and a fellow at the Center on Budget and Policy Priorities, has warmed to dynamic scoring, at least as its been done so far by the government.

While scoffing at estimates by groups like the Tax Foundation, Bernstein calls estimates by CBO and JCT “reasonable.”

The net effect of all of that is that, over the past year, dynamic scoring — which for decades was an obscure hobby horse of the far right — has increasingly gone mainstream.

But if there is a growing consensus around using dynamic scoring, that doesn’t mean there’s agreement on how.

If Congress cuts individual tax rates, for example, what happens exactly? Do people work more? Because now they’re effectively making more money per hour. If so, how much more? Working more means paying more taxes, which means more revenue flowing into the Treasury, which means maybe Barthold should be putting a bigger discount on tax cuts.

Do they work less — because now they can maintain the same standard of living while spending less time at the office? If that’s the case, then there’s less dynamic revenue coming in, and the price tag of cutting taxes will be higher.

What about businesses? Economists generally agree that offering companies tax breaks for making investments that make them more productive boosts growth over the long term. But how much more, exactly?

And what happens when tax cuts add to the deficit? The government has to borrow more money to cover the budget shortfalls created by cutting taxes, which increases the competition for all the money out in the world that’s available to be borrowed. Does that increase interest rates? If so, that creates a drag on the economy. What happens if a business gets a tax cut for buying a new machine, but has to pay higher interest rates on the money it borrows to make the purchase? Does it still buy the piece of equipment?

And are people even aware of when Congress changes tax laws? Are they paying attention? People’s expectations about the future can make a big difference, especially if there are dramatic tax changes in the offing. Bernie Sanders, for example, wants to almost triple capital gains taxes. That would surely have a major impact on the stock market, with people rushing to sell their holdings before it could take effect. But what people think about the future is really hard for economists to analyze, and different dynamic scoring models can assume very different things.

“Literally, shelves of studies try to estimate the responsiveness of the economy to changes in taxes,” said Marty Sullivan, chief economist at the nonpartisan Tax Analysts. “The estimates of those elasticities are central to all tax economics, and there is tremendous controversy about them.”

But exactly which assumptions are used can go a long way toward determining the dynamic-scoring answer.

In 2014, JCT issued a purely advisory dynamic scoring estimate of a tax-reform proposal by Dave Camp, then-chairman of the House Ways and Means Committee. It examined the proposal under a number of scenarios and found that, depending on which assumptions were used, the plan would boost the economy anywhere from 0.1 percent to 1.6 percent. For lawmakers, that would have translated into $50 billion to $700 billion in essentially free revenue.

“If you’ve got an estimate” that is 16 times the other, then “I don’t know what kind of answer you have,” said Jane Gravelle, a longtime tax economist at the nonpartisan Congressional Research Service. “Until we can get some kind of consensus around macro effects, then we’re forcing” JCT “to do something that’s almost impossible.”

Part of the reason for all the disagreement is that it’s hard to draw a straight line between tax rates and growth, or even elements of growth. There have been periods when taxes were much higher than current rates, and the economy did well. The reverse also has been true. In 1993, for example, President Bill Clinton signed a $240 billion tax increase, mostly on the wealthy. At the time, Republicans said it would kill jobs, but the economy actually grew faster the following year — by 4 percent, up from 2.7 percent the previous year. In 2001, President George W. Bush cut taxes by $1.35 trillion, and the economy grew just 1.8 percent the following year.

Some say that proves there isn’t much relationship between taxes and growth; others aren’t so sure. That’s because they say the economy might have done even better had Clinton not raised taxes, or would have done more poorly if Bush had not cut taxes.

It’s impossible to know, said Alan Viard, an economist at the conservative American Enterprise Institute. “If we had two histories where the only thing that changed was the tax change, we could look at both histories, and then we could know the answer,” he said. “But we can only see the path we took.”

“People are still arguing about all these tax laws — did they help the economy, did they hurt it?” he said. “There’s never any tax changes where we know what its effects actually were.”

But that lack of certainty hasn’t prevented organizations like the Tax Foundation from using their own dynamic scoring models to make bold predictions about the Republican presidential candidates’ tax plans. Perhaps it’s not surprising given the ideological drift of the foundation that it found increased economic growth would cover big chunks of the costs of the candidates’ proposals. Before Ted Cruz dropped out of the presidential race, the Tax Foundation estimated that the senator’s $3.66 trillion plan would drop to a manageable $768 billion if dynamic scoring principles were applied, a whopping 77 percent reduction.

With the exception of Arthur Laffer, the godfather of supply side economics, who thinks that the Tax Foundation was too cautious, most economists think that kind of modeling is more than a little wishful.

“We read their stuff,” said Tom Barthold, when asked about the Tax Foundation’s aggressive estimates. He’s sitting in his office, on the fifth floor of a nondescript office building behind the Capitol, down the hall and around the corner from the Architect of the Capitol. He’s joined by two of his deputies, Bernie Schmitt and Pam Moomau. “We don’t think it’s generally appropriate, particularly to you, as opposed to in-house, to comment on other people’s stuff,” said Barthold. JCT does not analyze political candidates’ proposals — only legislation introduced in Congress — so it’s been a bystander in the debate over the Republican candidates’ plans.

But whoever is elected, if they have designs on the tax code, they’ll have to go through the JCT. Congress is required by law to use JCT’s estimates. (JCT handles all tax legislation while CBO does everything else — spending, deficits, economic forecasts. The agencies sometimes work together when legislation, such as the Affordable Care Act, includes both spending and tax changes. CBO simply repackages JCT numbers in its reports, with a footnote crediting the agency.)

Though JCT is little known outside the Capitol, its influence is evident by the lobbyists who are eager to meet with its analysts, hoping to push them one way or another. When the U.S. Capitol Historical Society sponsored an event in February, marking JCT’s 90th birthday, the sponsors included American Express, Procter & Gamble and Allergan, which at the time was in the thick of a controversial “inversion” with Pfizer, a deal later broken up by the Obama administration’s crackdown on the tax-avoidance maneuvers.

Barthold has been running the office since 2009, but he’s been at the agency since 1987. That means he’s not only been there since shortly after the last tax overhaul, in 1986, but he's also been there longer than every member on either the House and Senate tax-writing committees, except for Reps. Charles Rangel (D-N.Y.) and Sander Levin (D-Mich.).

Barthold is not only the chief tax budgeteer, he’s also Congress’ tax teacher, routinely appearing at hearings to answer lawmakers’ questions about how the tax code works and what sort of trade-offs they might consider when writing tax bills.

The advent of dynamic scoring represents a huge change in how JCT does its work, but the agency is hardly coming to the issue cold. Republicans have been prodding it for years to step up its research into dynamic scoring, and the agency has issued a steady stream of reports, conferences and other investigations into how it might work. Even skeptics say JCT has made significant progress over the years.

“We’re a little more suspicious of the science, but I say that while giving Tom Barthold and [the] joint committee enormous, enormous credit because they have almost singlehandedly advanced the science of macroeconomic analysis of revenue measures to points that no one would have anticipated when people started talking about dynamic scoring a decade or more ago,” a top Democratic tax aide said. “They really have advanced the ball.”

The agency uses three models of the economy to produce its estimates. They’ll use different ones in different circumstances, saying they’re good at different things. “Different macro models have some different strengths and weaknesses in terms of emphasizing different aspects of the economy,” the tax aide said.

They’ve been developing one of the models in particular to analyze international tax reform proposals. So if Brady, the Ways and Means chairman, produces his international taxation plan, they’ll rely heavily on that one.

JCT also has one great advantage over everyone else when it comes to dynamic scoring: It can look up anyone’s tax return. So if it wants to know how a proposed change might affect, say, the oil industry, it can look up Exxon’s return.

What sort of policies do well under its models? How can lawmakers work dynamic scoring? Barthold, loath to recommend any policy, bristles.

“I don’t like you asking about ‘working the model,’” he said. “We don’t view our models as like a card game or something, where we’re the house and [lawmakers] are trying to beat the house. I’m not saying they don’t act that way — I said we don’t like thinking about it that way.”

But he offers some general guidance on what JCT might look favorably upon.

“Here are some things that can be pro-growth: things that increase incentives to work, increase incentives to save, invest domestically as opposed to investing abroad,” Barthold said.

“Those should generate some long-run growth because you have more labor-force participation, you have more capital, so more capital, workers can be more skilled, so higher productivity, which is higher wages. All of that can produce increased demand for goods and services. Reductions in tax rates also increase cash flow to individuals, which can increase demand for goods and services in and of itself.”

On the other hand, he said, “If you just say, ‘Well, let’s just cut all these tax rates,’ then the deficit and financing the deficit is an issue.”

“If the government has to borrow more, that can drive up borrowing costs — that makes it more expensive for the private sector to add capital. If they don’t add capital, then you don’t get the productivity growth, you don’t get the wage growth, you don’t get the increased demand for investment, so you don’t get growth. So creating a deficit is anti-growth. Cutting tax rates can be pro-growth, and there’s a trade-off.”

The fact that so many other groups are now doing their own dynamic scoring puts more pressure on JCT, said Barthold, because lawmakers often want to know why their numbers don’t match.

“It changes the landscape both for the members and, since we respond to members, it clearly changes the working landscape for us,” he said. “We try to tell members what they want to know about us versus them.”

“It may put more pressure on a day-to-day basis to make sure we being middle of the road, that we have good economic analysis behind what we’re doing.”

Since dynamic scoring rules took effect, JCT has produced a couple estimates of relatively low-profile tax bills that provide some clue as to how it might implement dynamic scoring. It knocked 4 percentage points off the price of a bill approved by the Senate Finance Committee that would have permanently extended a business tax break for making investments, known as “bonus depreciation.” (By comparison, the Tax Foundation said the economic benefits would reduce the cost of that bill by 78 percent.)

The economic effects of the bill were mixed, JCT said. It saw increased economic growth producing $30.7 billion in additional revenue over a decade. But it said the bill would push up interest rates, which would increase the cost of servicing the debt. For that, it knocked off $17 billion. The net $13.7 billion in dynamic revenue reduced the total cost of the bill to $267 billion from the $280.7 billion it would have been under the old budget rules.

The cost of another bill extending a bunch of temporary tax provisions was reduced by 11 percent, JCT said, thanks to dynamic scoring.

Ironically, the agency never produced a macroeconomic analysis of the single biggest tax bill to pass Congress since the new rules were adopted, a $680 billion tax cut approved in December.

That’s because lawmakers didn’t give JCT enough time to produce its analysis, which can take weeks. “It takes a heck of a lot of work,” said Barthold. Lawmakers were haggling over that bill until the last minute, and then quickly approved it before opposition to the plan could organize; the rules allow JCT to skip dynamic analyses when it’s not practicable. Surprisingly, few lawmakers seemed to notice or care.

JCT’s work has been criticized by some on the right. The Tax Foundation says it’s wrong about deficit-boosting tax cuts pushing up interest rates, and is therefore understating the benefits of cutting taxes.

“The last seven years has proved that wrong,” said Scott Hodge, president of the Tax Foundation. He also says JCT is too secretive about how it comes up with its numbers.

“It is certainly encouraging to see the Joint Committee do this kind of work, but, at the same time, they are still very opaque in how they’re coming up with some of these results,” said Hodge. “They need to be much more transparent.”

The first real test of the new rules will come when Brady and Finance Chairman Hatch release their tax reform plans. Brady says his panel will take up his tax plan sometime this year, while Hatch is expected to release his plan in June.

Both are relying on dynamic scoring to finance their plans, and that will require JCT to make a lot of judgments about what will surely be novel tax proposals. Brady, for example, wants to create a patent box, which is jargon for offering high-tech, pharmaceutical and other firms special low tax rates on their profits tied to intellectual property. The idea is popular in parts of Europe, but the U.S. has never had anything like it. Hatch wants to give companies a deduction for paying dividends to their shareholders. That would reduce the effective taxes they pay, though it would also give them a new incentive to pay out profits they might otherwise use to reinvest in their businesses.

Of course, it’s possible — depending on how JCT interprets dynamic scoring — that it will prove to be neither the boon Republicans expect nor the disaster Democrats fear. It could end up being a whole lot of nothing. After all, asking a bunch of nonpartisan Ph.D. economists to count up the benefits of your tax legislation raises the possibility that they won’t find many.

That’s what happened in California, where Republicans in the state government experimented with dynamic scoring in the 1990s. They had hoped it would dramatically reduce the cost of cutting taxes, though they also wanted dynamic scoring to be credible, so they contracted with economists from the University of California at Berkeley to build their model. But it ended up spitting out numbers that disappointed Republicans, showing taxes would have only a middling impact on the economy.

“The numbers just weren’t exciting,” said Brad Williams, who was director of budget overview and fiscal forecasting at the state’s Legislative Analyst’s Office. In 2000, lawmakers there allowed the statute requiring dynamic scoring to expire.

Even so, said Williams, dynamic scoring had an important effect on the state’s tax debates.

“What it really did was tamp down on the rhetoric” and “extreme claims” about what taxes would — or would not — do for the economy, he said.

In the meantime, dynamic scoring is already changing how tax bills are written in Congress.

Republicans were thrilled with JCT’s analysis of Camp’s tax bill producing as much as $700 billion in dynamic revenue, but they were shocked Barthold said the business portion of his proposal would actually hurt the economy.

Camp proposed slashing the corporate tax rate to 25 percent, from the current 35 percent, something Republicans have been promising to do for years. But Camp would have paid for that by getting rid of accelerated depreciation, obscure provisions in the law that allow businesses to write off the cost of their investments over a number of years.

JCT essentially said that was a bad trade. The benefits of cutting the corporate rate were negated by getting rid of those provisions, JCT said.

Since then, there has been a sharp swing among Republicans, in both Congress and on the presidential campaign trail, away from the Camp approach. Lawmakers are now looking for other, less economically damaging ways to finance a cut in the corporate rate.

Sullivan, of Tax Analysts, is skeptical of dynamic scoring. But he says that, at the very least, it’s teaching members of Congress about the economic consequences of their decisions.

“Cutting depreciation to pay for lower rates is hurtful to the economy because depreciation is a better incentive than rate cutting,” said Sullivan. “Members had no idea about that. Now they understand.”

“It’s forcing them to become educated about economics, and I think that is a very good thing.”

- Publish my comments...

- 0 Comments